The Beyond 9 to 5 Living Blog

Explore a life unrestricted by the 9 to 5 at Beyond 9 to 5 Living, your go-to source for inspiration, tips, and stories on achieving balance, financial freedom, and intentional living. Dive into a world where family, passion, and health coexist seamlessly with work, and discover how to craft a life filled with purpose. Start your journey today and live beyond the 9 to 5. Call to Action Headline

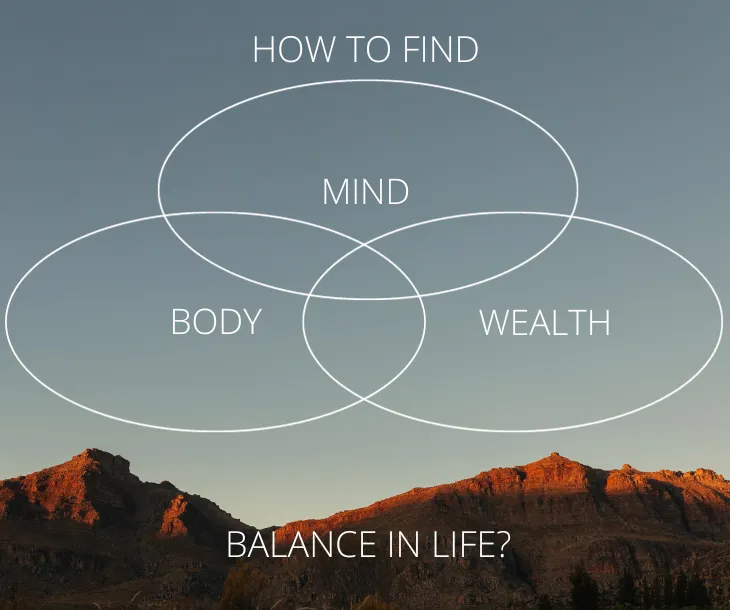

Achieving Work-Life Balance: Prioritizing Mind, Body, and Wealth

Discover the secrets to achieving work-life balance by prioritizing mind, body, and wealth. Learn how to balance health and wealth for a fulfilling life.

In today's fast-paced digital era, where home offices and virtual meetings have become the new normal, professionals face the challenge of balancing their personal and professional lives. With the lines between work and home becoming increasingly blurred, achieving a harmonious balance between mind, body, and wallet has become more essential than ever. This is particularly true for those who are juggling work-from-home duties, frequent travel, and family responsibilities. However, finding the right strategies to harmonize physical well-being, mental peace, and financial stability in such a dynamic and demanding environment can be daunting. It requires a thoughtful approach and a commitment to prioritizing self-care and financial goals amidst the ever-changing demands of the modern work landscape.

The Intricate Dance of Health and Wealth

Have you ever noticed how financial stress can lead to sleepless nights, impacting your overall well-being and ability to perform at your best? Similarly, a sedentary lifestyle can hinder your professional productivity, affecting your financial stability in the long run. It's important to recognize the intricate connection between your physical health and financial well-being, as they constantly influence and interact with each other. When you prioritize your physical health, you improve your overall quality of life and enhance your ability to make sound financial decisions. On the other hand, when you take control of your financial situation, you alleviate stress and create a solid foundation for a healthier lifestyle. Understanding and nurturing this symbiotic relationship can better balance your mind, body, and wealth, leading to a more fulfilling and prosperous energy-filled life.

A Balancing Act

A healthy lifestyle often requires investment, whether it's allocating funds for quality food, fitness memberships, or wellness resources. However, it's important to note that financial stress can significantly impact your mental and physical health. Striking a balance between investing in your well-being and managing your finances can be a delicate task. One approach is to prioritize and plan your expenses, ensuring that you allocate a portion of your budget towards activities and resources that promote your physical and mental well-being. This could include setting aside funds for nutritious meals, exercise equipment, or self-care practices. Additionally, exploring cost-effective alternatives such as home workouts, outdoor activities, or free wellness resources can help you maintain a healthy lifestyle without straining your finances. It's also crucial to regularly assess your financial situation, identify areas where you can make adjustments or cut back, and seek professional advice if needed. By balancing investing in your health and managing your finances responsibly, you can create a sustainable, abundant, and fulfilling lifestyle supporting your physical well-being and financial stability.

Crafting Your Plan: A Step-by-Step Guide

Step 1: Financial Fitness Check-Up

You can start by assessing your financial health. Are you budgeting effectively? Are there unnecessary expenses you can cut down? Tools like Mint or YNAB can be excellent for tracking spending and setting budgets.

Step 2: Investing in Your Health

Allocate a portion of your budget to your health. This might mean a gym membership, ergonomic work-from-home furniture, or healthier meal options. Remember, investing in your health is not an expense but a long-term investment in your quality of life and work productivity.

Step 3: Mental Wellness Matters

Mental wellness, mindfulness, and spirituality are pivotal to a balanced life. Practices like meditation, yoga, journaling, and even simple daily walks can significantly reduce stress, increase happiness, and foster a sense of spiritual connection. Engaging in these activities allows you to better understand yourself and the world around you. To make these practices more accessible, various apps like Headspace or Calm offer guided meditations and mindfulness exercises, which can be easily integrated into your busy schedule. Incorporating spirituality into your daily routine can enhance your overall well-being and create greater peace and fulfillment.

Step 4: Cultivating Financial Growth

What about growing your wealth? Consider simple investment options like a Roth IRA or a low-cost index fund. Websites like Investopedia can be great resources for beginners. I love the Acorn app for personal finance. It's a modern-day piggy bank that allows you to save your spare change and create a path to financial growth. It helps build good financial habits. There are several other benefits to the app as well.

Step 5: Balance Through Routine

Establishing a daily routine incorporating dedicated time for work, exercise, family, and self-care is essential for achieving a healthy work-life balance. Consistency in following this routine can lead to improvements in both your physical health and financial success. By prioritizing these key areas of your life, you can ensure that you simultaneously care for your mind, body, and wealth. This holistic approach allows you to maintain optimal well-being while also pursuing your professional goals.

How do you currently balance your physical health and financial wellness? Are there specific strategies or practices you follow to maintain a healthy lifestyle while managing your finances effectively? In what ways do you prioritize your well-being and financial goals simultaneously? Are there areas where you could improve in terms of achieving a better balance between your physical health and financial well-being?

Balancing mind, body, and wallet, especially in a work-from-home environment, is a purposeful journey of making intentional choices. It involves aligning your lifestyle and financial decisions with your overall well-being goals and nurturing a sense of abundance in all aspects of your life. You can create a harmonious equilibrium that fosters personal growth and fulfillment by consciously prioritizing self-care, physical activity, and financial stability. This deliberate approach allows you to cultivate a mindset of purpose, where you actively seek opportunities to nurture your mind, body, and financial well-being, ultimately leading to a more balanced and fulfilling life.

Achieving a harmonious balance between mind, body, and wealth is crucial in today's fast-paced and demanding world. The intricate connection between physical health and financial well-being cannot be ignored, as they constantly influence and impact each other. By recognizing the importance of this relationship, you can take the first step towards creating a fulfilling and prosperous life.

Start by assessing your financial health and identifying areas where you can improve. Commit to prioritizing your physical and mental well-being, understanding that investing in your health is an investment in your overall quality of life. Create a routine that allows you to strike a balance between work, self-care, and financial goals. This may involve setting aside time for exercise, healthy eating, and relaxation while also managing your finances responsibly.

Remember, achieving work-life balance is an ongoing journey that requires dedication and self-awareness. Be mindful of the choices you make and seek support when needed. By taking control of your physical health, mental well-being, and financial stability, you can create a life that is not only successful but also fulfilling and sustainable. So, take the first step today and embark on this transformative journey towards achieving a harmonious balance of mind, body, and wealth.